Reading Room & Genealogy Institute

Mon-Thurs: 9:30am-4:30pm

Exhibit Spaces

Mon-Wed: 9:30am-4:30pm

Thurs: 9:30am-8pm

Fri: 10am-3pm

Sat: Closed

Sun: 11am-5pm

Make sure to check our holiday closures prior to visiting.

Last entry to the Center for Jewish History Exhibitions, Reading Room, and the Genealogy Institute is 30 minutes before closing. The last call to page items in the Reading Room and Genealogy Institute is 3pm.

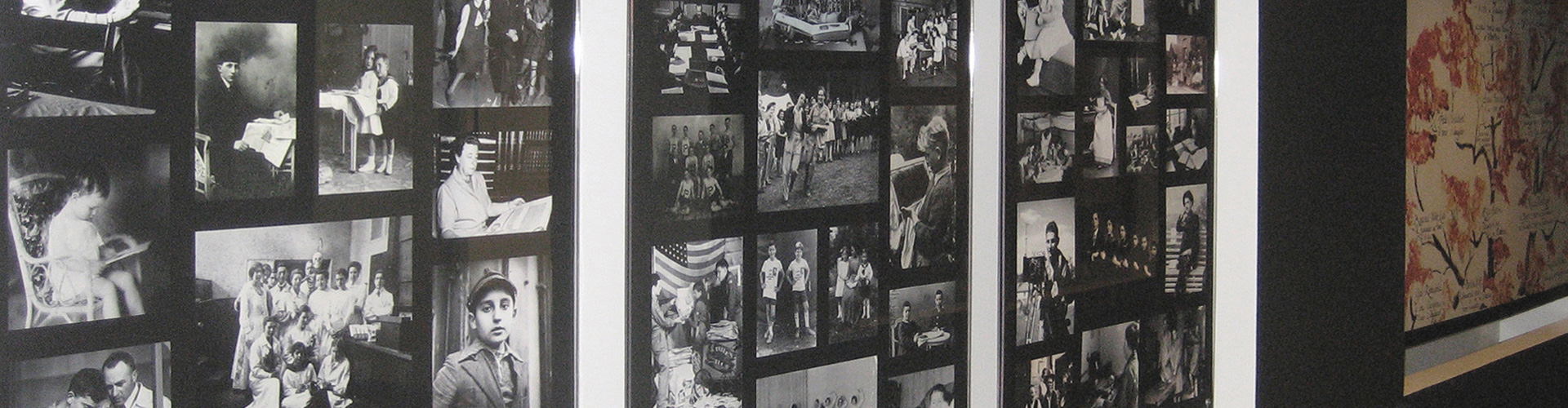

The Center for Jewish History is home to five partner organizations: American Jewish Historical Society, American Sephardi Federation, Leo Baeck Institute, Yeshiva University Museum, and YIVO Institute for Jewish Research. Through the work of the Center, the collections - which comprise more than 500,000 volumes, 100 million documents and thousands of pieces of artworks, textiles, ritual objects, recordings, films and photographs - are preserved, digitized and made accessible to scholars and audiences world-wide.

Create your Legacy at the Center for Jewish History and support the Center's mission to illuminate the history, culture and heritage of the Jewish people. You will also help to make this history accessible to scholars worldwide, young and old.

How do I make a gift under my will to the Center?

How can I provide income to myself and a loved one?

How can I create an enduring gift at the Center?

How can I designate the Center as the beneficiary of my financial accounts?

Learn more about becoming a member of the Legacy Society.

Contact the Center’s development office at (212)294-8309 or development@cjh.org to begin the conversation.

With a gift under your will or living trust, you are providing support for the Center’s future.

The benefits of creating a charitable bequest include:

Here is sample language that you can share with your attorney:

Outright Bequest:

I hereby give to the Center for Jewish History, located in New York City, the sum of _____ dollars (or ______% of the total value of my estate).

Specific Bequest:

I hereby give to the Center for Jewish History, located in New York City, (insert description of item).

Residuary Bequest:

I hereby give to the Center for Jewish History, located in New York City, all (or ______%) of the rest, residue and remainder of my estate.

Contingent Bequest:

If any of the above-named beneficiaries should predecease me, I hereby give his or her share of my estate to the Center for Jewish History, located in New York City.

Named Endowment Fund:

I hereby give to the Center for Jewish History, located in New York City, the sum of $______ to establish a permanent endowment to be known as The ______ Endowed Fund, the principal and income of which shall be used for the general purposes of the Center for Jewish History [or named specific purpose at the Center for Jewish History]. The distribution of endowment funds is approved by the Board of Directors of the Center for Jewish History, in consultation with the President and senior staff. The Center for Jewish History may expend so much of an endowment fund as it deems prudent consistent with the requirements of the New York Prudent Management of Institutional Funds Act.

Information for your attorney:

The full legal name of the Center is Center for Jewish History. The legal address is 15 West 16th Street, New York, NY 10011. The Center’s Federal Tax ID number (TIN) is 13-3863344.

The information contained herein is not intended as legal or tax advice. Please consult with your attorney or tax advisor about your personal situation when considering an endowed or planned gift to the Center for Jewish History.

Do you have any suggestions for a gift to the Center that would also benefit me and my family?

You could consider contributing your property to a charitable remainder trust (CRT) that you create. You will receive an income tax deduction in the year you contribute the property to the CRT and you pay no capital gains tax on the transfer. Your trustee will invest the trust assets and make annual payments to you and/or a loved one, based on a payout rate chosen by you. You may choose a fixed rate of income (annuity trust) or a variable rate of income (unitrust). At the end the trust term, the remaining amount in the trust goes to the Center.

I would like to provide a gift for the Center today and an inheritance for heirs at a future date. Do you have any suggestions?

You could consider contributing your property to a charitable lead trust (CLT) that you create. You will receive an income tax deduction in the year you contribute the property to the CLT and you pay no capital gains tax on the transfer. Your trustee will invest the trust assets and make annual payments to the Center based on the payout rate chosen by you. At the end the trust term, the remaining assets, including appreciation, pass to your heirs at a reduced gift or estate tax cost.

The information contained herein is not intended as legal or tax advice. Please consult with your attorney or tax advisor about your personal situation when considering an endowed or planned gift to the Center for Jewish History.

We would be pleased to discuss with you how you can make an endowment gift named for a loved one. An unrestricted endowment is best since the needs of the Center change over time and your gift will be used where it is needed most. You may also want to create an endowment for a restricted purpose. Please call our development office to discuss ways for you to make an endowed gift so that we can ensure that we can meet your goals and ours.

The information contained herein is not intended as legal or tax advice. Please consult with your attorney or tax advisor about your personal situation when considering an endowed or planned gift to the Center for Jewish History.

You can name the Center as the beneficiary of your accounts, such as your financial and retirement accounts and even your life insurance policy. By doing so, you do not incur legal fees, assets are removed from your taxable estate, and they will not be subject to the probate process.

The Center can be named as the beneficiary of the following types of assets and accounts:

To name the Center as the beneficiary of these assets, contact the institution that manages your account or policy, and request a change of beneficiary form. After you complete the form, send it to your institutional manager and send a copy to the Center for Jewish History so that we will have a record of your intended gift.

The information contained herein is not intended as legal or tax advice. Please consult with your attorney or tax advisor about your personal situation when considering an endowed or planned gift to the Center for Jewish History.

Join our efforts to collect, protect, and preserve the archives, rare books, art, music and film at the Center for Jewish History so that future generations will be enriched for years to come.

By informing us of your planned gift, you will become a member of the Legacy Society and enjoy:

Here is what one Legacy Society member said:

“The Center is a gateway to our history. It is truly a source of inspiration. I’m proud that future generations will benefit from my gift to the Center.”

Learn more about becoming a member of the Legacy Society.

Contact the Center’s development office at (212)294-8309 or development@cjh.org to begin the conversation.

Center for Jewish History

15 West 16th Street, New York, NY 10011

212-294-8309

development@cjh.org

The information contained herein is not intended as legal or tax advice. Please consult with your attorney or tax advisor about your personal situation when considering an endowed or planned gift to the Center for Jewish History.